Student Loans and Entrepreneurship: An Overview

Bottom line: Rising levels of student loan debt depresses entrepreneurship, income, and employment. Student loan debt has serious implications for job creation and American entrepreneurship because funds that would otherwise go to starting a business are diverted to debt servicing.

The relationship between student loan debt and entrepreneurship sits at the intersection of many questions related to labor markets, higher education, business dynamism, innovation, and capital markets.

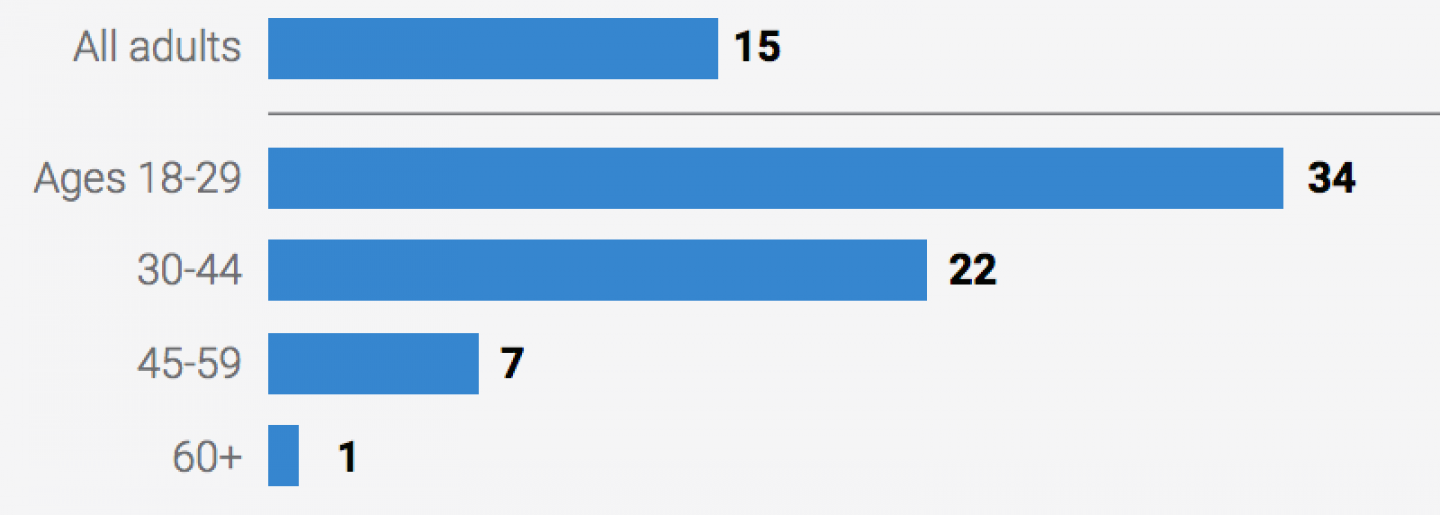

Nearly 1 in 6 adults in the U.S. has outstanding student loan debt. Among those between the ages of 18 and 29, 1 in 3 reported having student loan debt. Federal student debt tripled from just over $516 billion in 2007 to $1.5 trillion in 2020. Both the number of borrowers and the debt amount have increased in recent decades.

Two out of three college seniors (65%) who graduated from public or private nonprofit colleges in 2018 had student loan debt. The average student debt among graduating college seniors who took out student loans was $29,200.

Meanwhile, the share of new entrepreneurs aged 20-34 declined from 34% to 27% between 1996 and 2019. A survey of 800 individuals between the ages of 18 and 34 found that among those with student debt who currently own or have plans to own a business, nearly half reported that their student loan payments affected their ability to start a business. It also found that approximately 4 in 10 young adults believe that student loan debt had already impacted or would impact their ability to invest in an organization or hire new employees.

Student loan payments reduce the amount of cash that is available for individuals to invest directly in entrepreneurial activities. Some aspiring entrepreneurs with student loan debt may not be able to accumulate enough of the upfront investment necessary to start a business. And those who are able to start a business may do so with less capital. As a result, they may need to delay or simply forego investments in some business activities, which may impact profitability and business growth.

Student loan payments can also reduce an individual’s ability to save or create a savings buffer that would free them up to engage in new business activity. Entrepreneurship may not provide a steady and predictable income immediately, and a business may need time to become viable enough to produce sufficient income. Student debt servicing makes it more difficult for entrepreneurs to go through these periods of little or no income.

Read the full study HERE.

Percent of Adults Saying They Currently Have Outstanding Student Loan Debt for Their Own Education

Findings:

- More than one-third of American adults aged 18-29 have student loan debt and about one in six adults has outstanding student loan debt.

- Federal student debt tripled from just over $516 billion in 2007 to $1.5 trillion in 2020.

- The share of new entrepreneurs aged 20-34 decined from 34% to 27% between 1996 and 2019.

- Student loan debt has serious implications for job creation and American entrepreneurship because funds that would otherwise go to starting a business are diverted to debt servicing.

Read the full study HERE.