Does a One-Size Fits All Minimum Wage Cause Financial Stress for Small Businesses?

Bottom Line: The ongoing policy discussion on increasing the federal minimum wage to $15 per hour requires a thorough analysis of its impact on small businesses because wages comprise a significant portion of their operating costs. This study finds that one-size-fits-all minimum wages cause some small businesses, industries, and areas frictions in absorbing the increased cost of labor. As a result, affected businesses experience financial stress or defaulting.

Not all affected firms would have the flexibility to immediately adjust their capital–to–labor ratio or pass on the increased minimum wage costs to their customers. Small, young, labor-intensive, minimum-wage sensitive establishments and businesses located in competitive and low-income areas experience higher financial stress. This eventually leads to a higher exit rate and a lower entry rate.

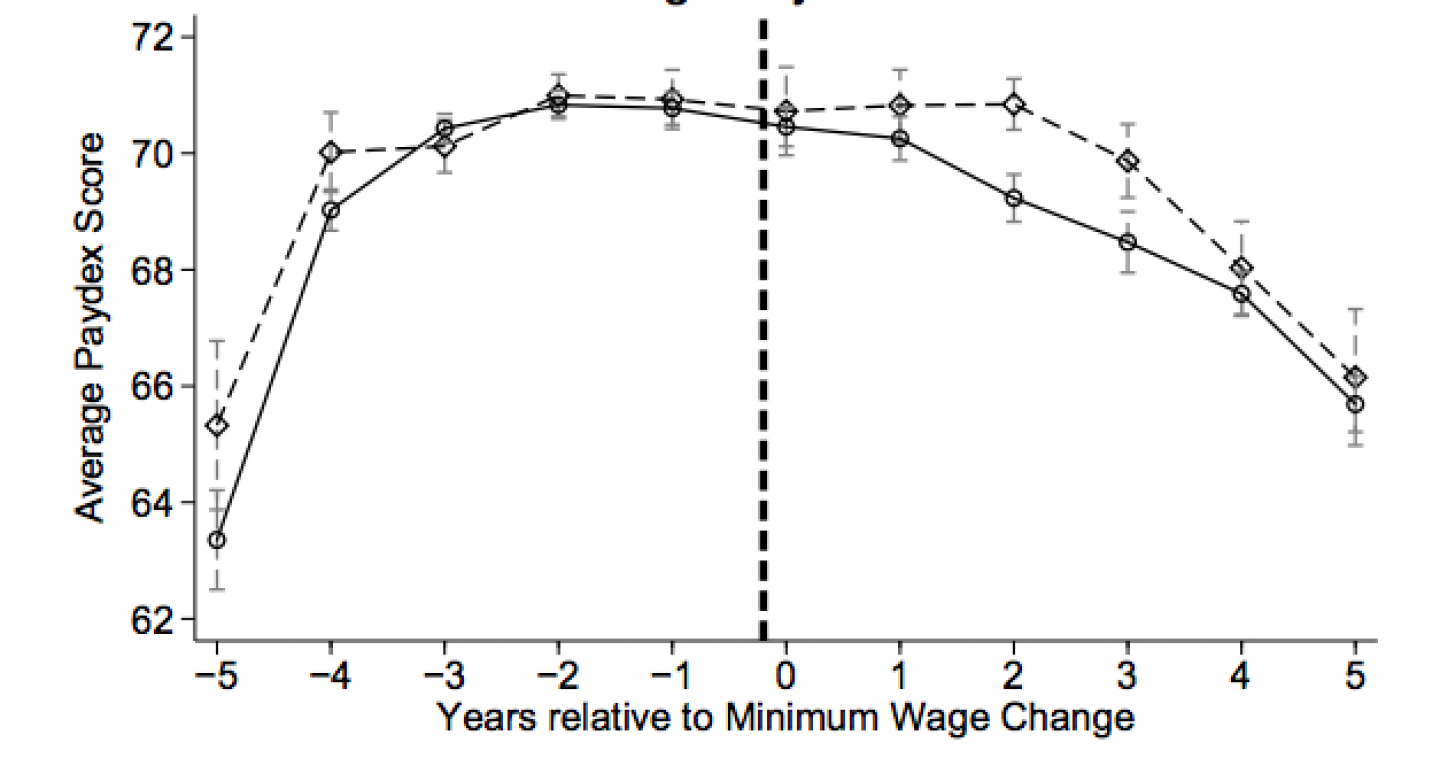

Using inter-temporal variation in whether a state’s minimum wage is bound by the federal minimum wage and using credit score data for approximately 15.2 million establishments for 1989–2013, the study finds that increases in the federal minimum wage worsen the financial health of small businesses in the affected states.

The study evaluates the likelihood that a business will make payments to suppliers or vendors on time, suggesting that the minimum wage can affect the availability of credit and interest rates for small businesses. The authors find that a dollar increase in the federal minimum wage corresponds to an almost 1.0 percentage point reduction in an establishment’s credit in affected states.

This 1.0 percentage point reduction implies a delay of 1-2 days beyond the typical payment terms of 30 days. In the sample, the median establishment will delay its payment by five days, on average, beyond the payment terms. This corresponds to an increase in the exit probability by 2.2 percentage points or a 25% increase from the 8.5% baseline annual exit probability.

Small and young establishments, which are more likely to have financial constraints, experience a more significant decrease in their credit scores. Establishments that are labor-intensive such as restaurants and retail, find it more difficult to absorb minimum wage increases and hence experience a more significant decline in their credit scores.

The study also finds that increases in the minimum wage lead to lower bank credit, higher loan defaults, lower employment, a lower entry and a higher exit rate for small businesses. The results are robust to using nearest-neighbor matching and geographic regression discontinuity design. These results document some potential costs of a one-size-fits-all nationwide minimum wage on small businesses.

Read the full study HERE.

Findings:

- Establishments that are labor-intensive such as restaurants and retail, find it more difficult to absorb minimum wage increases and hence experience a more significant decline in their credit scores.

- The study finds that a dollar increase in the federal minimum wage corresponds to an almost 1.0-point reduction in an establishment’s credit in affected states. This 1.0-point reduction implies a delay of 1-2 days beyond the typical payment terms of 30 days.

- This delay corresponds to an increase in the exit probability by 2.2 percentage points or a 25% increase from the 8.5% unconditional annual exit probability.

- The study also finds that Increases in the minimum wage lead to lower bank credit, higher loan defaults, lower employment, a lower entry and a higher exit rate for small businesses, suggesting significant downsides of a $15 national minimum wage.

Read the full study HERE.