Access to Capital for Entrepreneurs: Removing Barriers

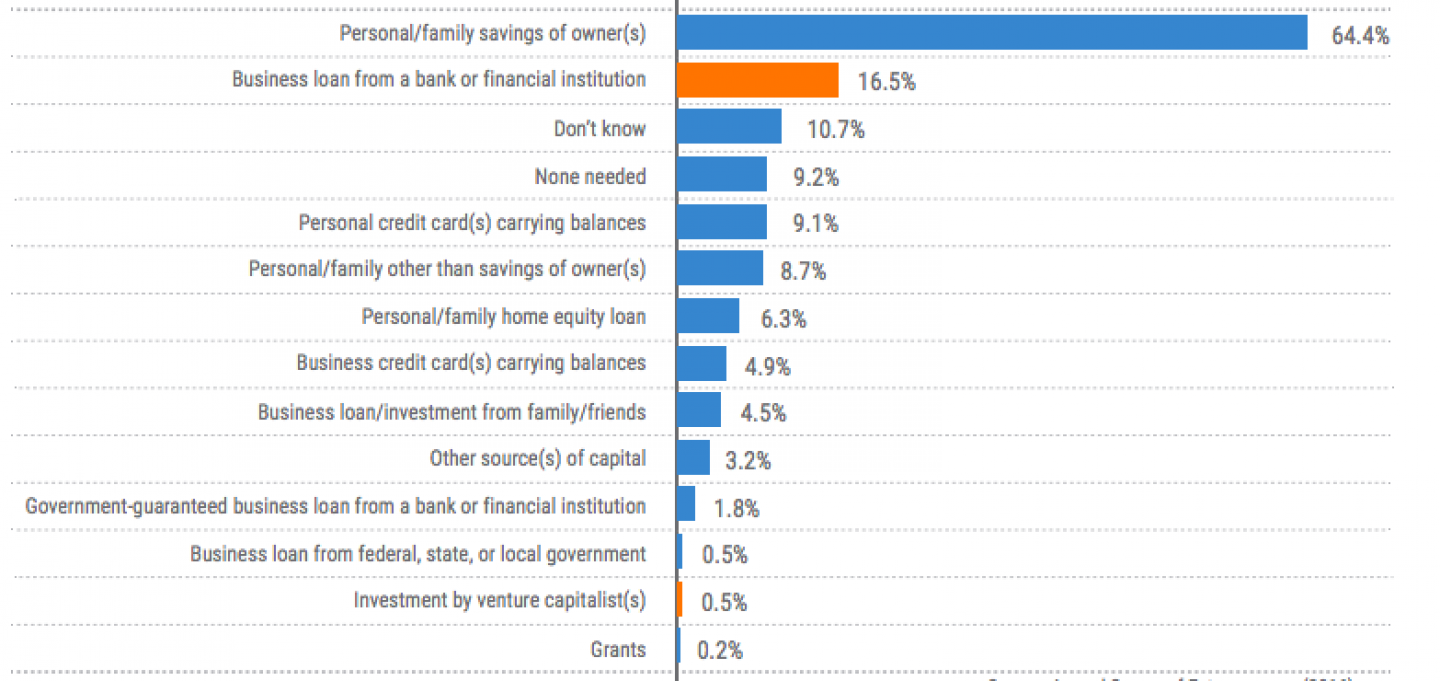

Bottom Line: Lack of access to capital is often cited as one of the primary barriers facing entrepreneurs. Access to capital plays an important role in entrepreneurship, in both direct and indirect ways. Entrepreneurs face geographic, demographic, and wealth barriers, exacerbated by a capital market structure that does not effectively find and support the majority of entrepreneurs. The Kauffman Foundation recently launched a national Capital Access Lab to catalyze new financing mechanisms to serve the more than 83% of entrepreneurs who don’t access venture capital or bank loans, increasing capital investment to underserved entrepreneurs who have been historically left behind.

Most efforts to expand access to capital and increase new business creation and success have focused on supporting small business lending and venture capital, direct efforts to provide capital to entrepreneurs. Few of these efforts have created systemic change.

Rather than creating and growing specific investment vehicles to invest directly in entrepreneurs, organizations with influence—such as large institutions, foundations, and governments—could instead build up market infrastructure to enable the marketplace of entrepreneurs and capital mechanisms to solve problems.

There are new, innovative strategies that work at the system level or offer alternatives to bank loans and venture capital. An emerging group of people—known as “capital entrepreneurs”—is advancing new vehicles to reduce the barriers entrepreneurs face in accessing capital. They are building more flexible models of capital formation, driving innovation within equity and debt structures, and piloting and developing new ways to source entrepreneurs and deploy capital. These include revenue-based investing, entrepreneur redemption, online lending, crowdfunding, and blockchain.

These capital entrepreneurs would benefit from:

- New industry standards, categories, and technologies to mitigate the friction that limits the flow of capital to entrepreneurs.

- Professional communities of practice to help organize and clarify goals and objectives related to increasing access to capital.

- New strategies for capital aggregation to help increase the flow of capital and close market gaps.

The Kauffman Foundation has identified five types of infrastructure that show promise:

- Capital infrastructure. Greater diversity of investment vehicles and intermediary financial institutions can be developed to bridge the gap between money centers and the spectrum of entrepreneurs seeking capital.

- People infrastructure. Capital entrepreneurs have the opportunity to develop new investment vehicles that provide access to the 83 percent of entrepreneurs who are not served by private institutional capital.

- Information infrastructure. Enhanced data and technology can create stronger infrastructure and clearer standards for efficient market operations, speeding the flow of capital to a greater number of entrepreneurs.

- Knowledge infrastructure. More targeted research can better inform efforts to improve capital access for entrepreneurs, providing insight regarding the origin of capital market gaps and the effects of capital constraints on firms.

- Policy infrastructure. Entrepreneurs and capital entrepreneurs can be at the table to assert their voices when lawmakers and regulators are forming policies that affect the functioning of capital markets for entrepreneurs.

Interventions that show promise for systems change can strengthen the tools, communities of practice, and methodologies for capital entrepreneurs and allocators.

To read the full study, click HERE.

Findings:

- At least 83% of new businesses that hire are not accessing external private institutional capital at startup.

- Entrepreneurs face geographic, demographic, and wealth barriers, exacerbated by a capital market structure that does not effectively find and support the majority of entrepreneurs.

- An emerging group of people—known as “capital entrepreneurs”—is advancing new vehicles to reduce the barriers entrepreneurs face in accessing capital.

- The Kauffman Foundation recently launched a national Capital Access Lab to catalyze new financing mechanisms to increase capital investment to underserved entrepreneurs who have been historically left behind.