Energy Inflation Was By Design

BottomLine: The West is now facing its most severe energy crisis since the 1970s. It comes from an obsession with climate change policy and forcing seemingly endless amounts of more expensive and less reliable renewables and electric cars into the marketplace. In addition, the investing community via ESG has gotten into the act and is pushing “green funds” that command them a higher premium. In short, high prices for fossil fuel energy are an intended part of the progressive energy plan. All of this has now been disastrously exposed by Putin’s war in Ukraine that has shocked Western energy inflation and proven “alternative” energy as far more “supplemental.”

We must go back to the oil embargoes of the 1970s to remember an energy crisis like the one that West faces today.

It has been a steady push of increasingly progressive climate policy to artificially increase the cost of fossil fuels to force an “energy transition” to less reliable and more expensive “alternative energy,” namely renewable power systems like wind and solar and electric cars.

Since Russia’s invasion of Ukraine at the end of February 2022, however, energy prices have spiked to new heights, and the anti-fossil fuel position, particularly of Europe, has been exposed as a complete disaster.

Despite having rising domestic natural gas demand, for instance, Europe has been decommissioning some of its largest gas fields in the name of “fighting climate change.”

Russian energy imports have riskily filled in.

With crude oil prices surging to over $100/barrel and natural gas prices rising above $100/MMBtu, why would we expect anything else?

Fossil fuels meet over 80% of the energy demand in the West, so policies that block the production and transport of them are effectively guaranteed to install energy inflation.

The worsening reliance on Europe for Russian energy has shown that fossil fuels are nowhere near replaceable at scale, despite hundreds of billions of dollars in subsidies to force them to be.

Further, the investing community via ESG has also dangerously jumped on the anti-fossil fuel money train.

As it turns out in the marketplace, these “woke” Westerners have been the biggest supporters of far more realistic Vladimir Putin and his OPEC allies that seek global domination of world energy markets.

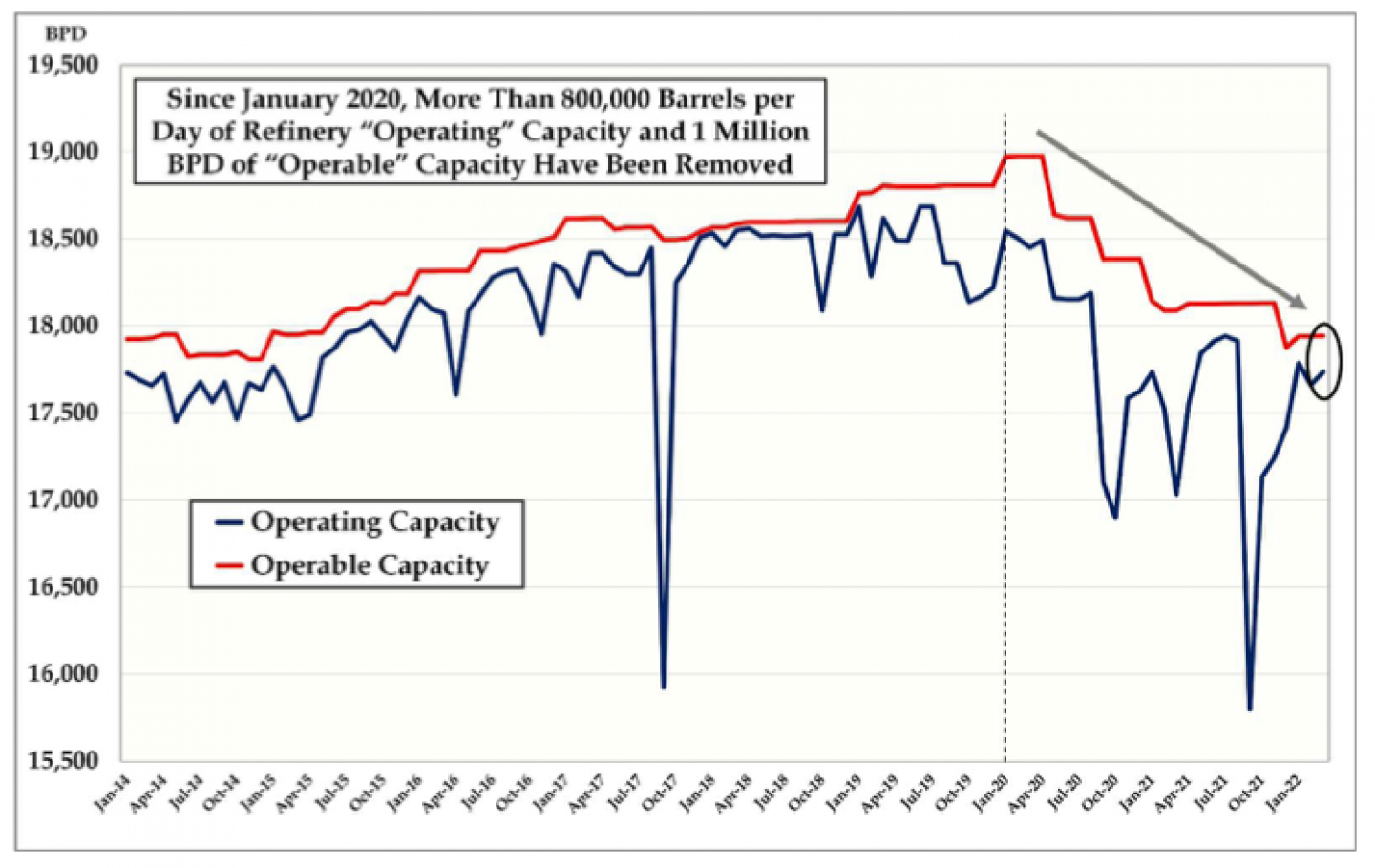

The anti-fossil fuel position in the West is perhaps best exemplified by the sharp decline in U.S. oil refining capacity.

This is an obvious problem: the U.S. is a growing country and oil is still the most vital fuel with no substitute whatsoever.

The present analysis from RealClearEnergy looks at how progressive Western energy policies to force “green energy” dreams has exploded into persistent energy inflation.

And as the case of Europe also proves, the inability of renewables and electric cars to gain significant market share is more about physics than forcing “huge investments” into them.

Ultimately, if what we keep hearing is “alternative” energy really, truly was, Europe would have the most alternative energy system in the world.

It does not, and it still overwhelmingly relies on fossil fuels from a Vladimir Putin that has devolved from precarious to dangerous.

Read the full study here.

U.S. Crude Oil Distillation Has Sunk (Thousand B/D)

Conclusions:

- This time clearly self-inflicted, the West is now experiencing its third energy crisis, one that was surely brought about by anti-fossil fuel policies, such as environmental laws forcing a large drop in U.S. oil refining capacity.

- Rooted in a climate change, renewable energy, and electric car obsession, high prices for fossil fuel energy are an intended part of the energy plan of the Western progressive leaders.

- The progressive energy goal is for artificially higher priced fossil fuels to force the adoption of massive amounts of renewables and electric cars, although Europe has already proven them more expensive and less reliable.

- Corporate and Wall Street ESG policies are another factor driving today’s energy crisis, blind woke investing that just works to favor far more realistic energy thinking in China and Russia.

Read the full study here.