An Analysis of Allegheny County’s Demolition Awards

Summary of Study

In 2020, Allegheny County increased by $15 the fee to record deeds and mortgages to fund the demolition of blighted properties. A state law – Act 152 of 2016 – permits counties to enact the fee.

The county plans to spend $1.9 million generated from the fee to fund the demolition of 100 structures. The 100 structures are located in 32 of the county’s 128 municipalities and in 22 of the 43 school districts.

Read the full policy brief here.

Feature Charticle

Findings:

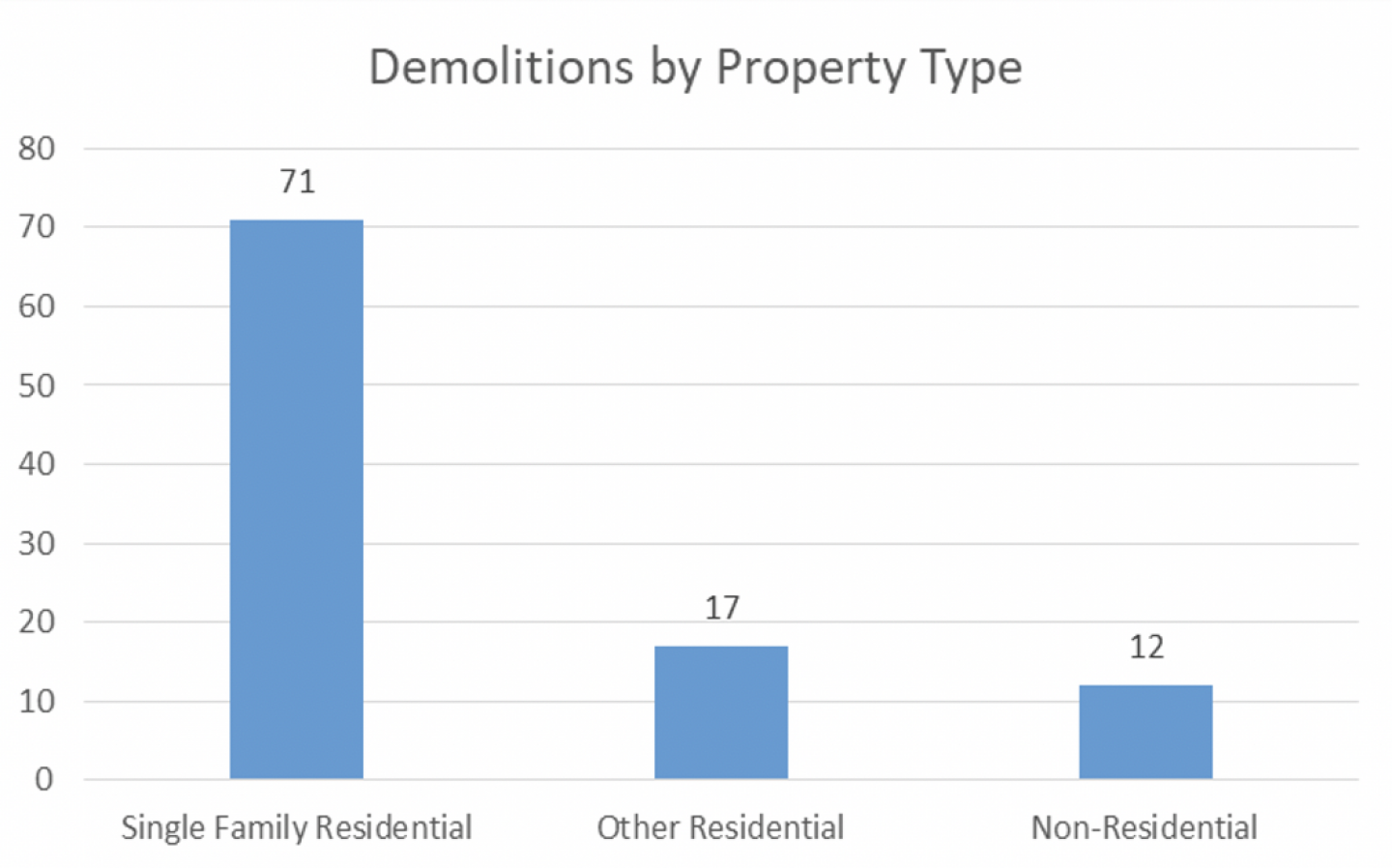

- 71 of the structures are single-family homes. Non-residential structures to be demolished include retail with upper-level apartments, a warehouse, and a church.

- By taxable status, 93 structures are taxable and seven are tax-exempt due to being owned by a government. The combined assessed value of the 93 taxable structures is $3.1 million.

- Act 152 is to sunset in 2027. That would make sense to give time to evaluate what has been accomplished by the fee and decide whether to reauthorize it.

- But a proposal to end the sunset and let the fee continue indefinitely passed one chamber of the General Assembly last summer and is now under consideration in the other. This seems imprudent. The fee should be sunset as originally intended, evaluated and then enabled again if merited.

Read the full policy brief here.