The Carbon-Neutral LNG Market: Creating a Framework for Real Emissions Reductions

Bottom Line: Demand for natural gas and liquefied (LNG) natural gas is set to grow in the decades ahead. Companies and countries, however, are seeking all possible ways to decarbonize their energy systems, so the use of these fossil fuels must become more sustainable. This has given rise to “carbon-neutral LNG,” where discussions of value chain carbon intensity and greenhouse gas accounting have become increasingly common. It is therefore in the gas industry’s best interest to go beyond the procurement of carbon credits to negate the emissions from gas and LNG. The adoption of offsets should be paired with a broader and deeper reduction in the emissions intensity, such as plugging methane leaks along the value chain and examining the possibility of a carbon tax.

As governments and companies consider options to decarbonize their energy systems, addressing greenhouse gas emissions (GHGs) from natural gas and liquefied natural gas (LNG) will inevitably become a greater concern.

The reality is that even as we shift to more renewable energy technologies, natural gas will remain integral to the world’s energy mix.

Not just lower carbon and abundant, gas is also versatile and provides the backup generation for wind and solar power that are naturally intermittent.

Yet still, without action to better account for, reduce, and offset natural gas and LNG emissions, the breadth and length of its use will increasingly come into question, something that the industry itself wants to avoid.

These questions surrounding the sustainability of gas could even come from countries with growing energy demand (e.g., China and India), who already see diminishing incentive to favor natural gas over high-emitting but fiscally cheap fuel sources, such as coal.

Amid these considerations, discussions of value chain carbon intensity and GHG accounting are becoming an important component of LNG trade, giving rise to the concept of “carbon-neutral LNG.”

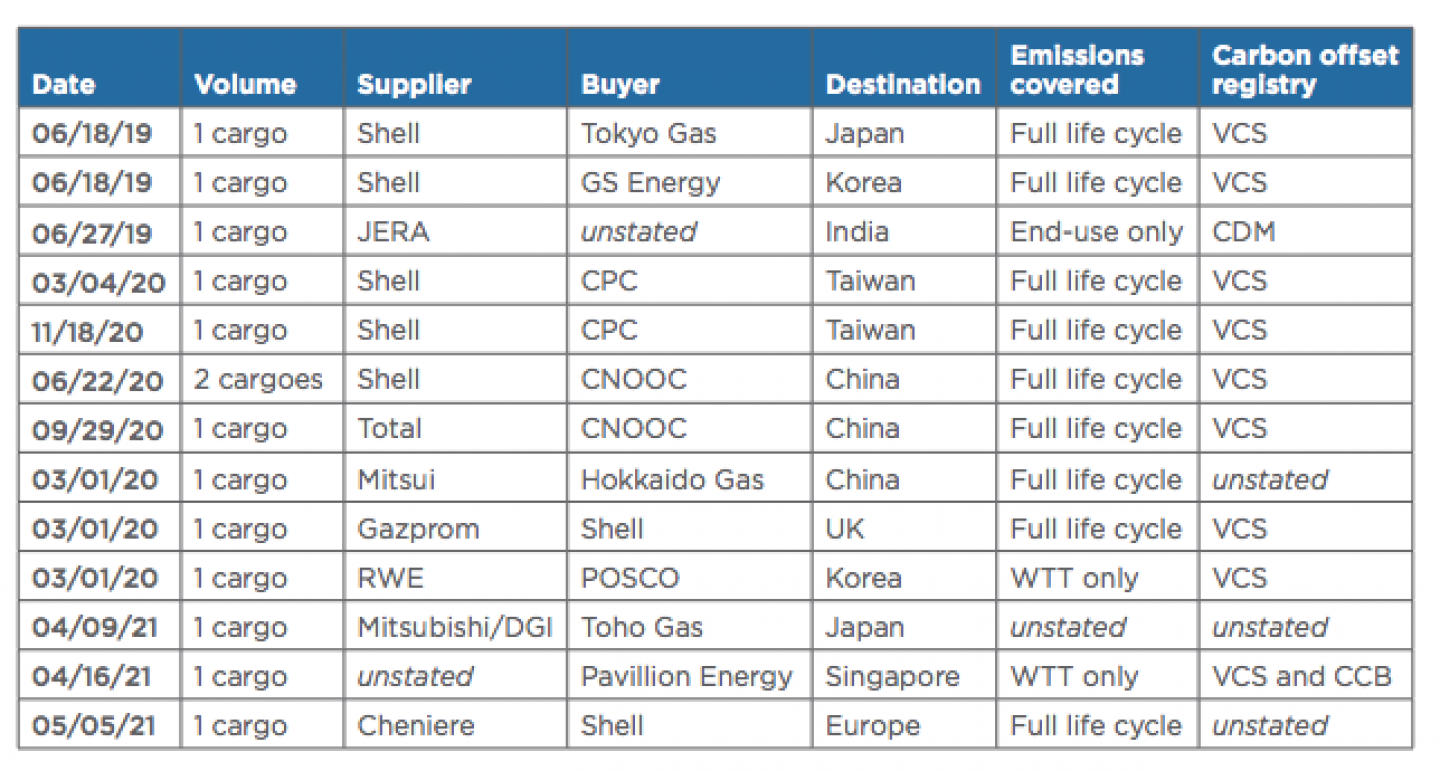

Over the past two years until July 2021, there were 14 delivered carbon-neutral LNG cargoes, although tiny compared to compared to over 5,000 cargoes of LNG being delivered globally in 2020 alone.

In the trade of carbon-neutral LNG, GHGs from supply and/or consumption are accounted for and offset by procuring and retiring carbon credits generated through GHG abatement projects, such as afforestation, farm/soil management, and methane collection.

Procurement of carbon credits, however, does not negate the emissions from natural gas and LNG, and accordingly, adoption of offsets should be paired with a broader and deeper reduction in the emissions intensity.

It becomes clear that efforts must be made to scale GHGs mitigation throughout the value chain, such as through leakage reduction and employment of less carbon-intensive liquefaction technology, as well as to offset remaining emissions through the procurement and retirement of high-quality carbon credits.

Serious questions remain about scaling the carbon-neutral LNG trade, including which emissions are accounted for, what methodology is employed in the emissions measurement and verification, and how the emissions are priced.

The latter could even include a carbon credit or a carbon tax.

If these questions are sufficiently addressed, natural gas and LNG would align better with global policy direction and emissions requirements.

The current study examines an existing and growing market trade behavior that has the potential to assist countries dependent on natural gas in meeting their climate targets during this transitory period for the world’s energy system.

This study is organized as follows:

- Section 1 outlines the current state of the carbon-neutral LNG trade.

- Section 2 suggests a structure for LNG GHG accounting based on existing accounting methodologies.

- Section 3 discusses the different forms through which emissions mitigation can be integrated into the LNG trade, including a discussion on the risks of “greenwashing,” or the process of conveying a false impression or providing misleading information about how a company's products are more environmentally sound.

- Section 4 highlights the implications of the growing carbon-neutral LNG market and provides recommendations to market participants and policy makers.

Read the full study here.

Completed Carbon-Neutral LNG Cargoes (as of June 2021)

Findings:

- Even with rapid advancements in renewable energy technologies, forecasts show natural gas will remain core to meeting global energy demand for some time, including as a backup fuel source for renewables themselves since they are naturally intermittent.

- In turn, discussions of value chain carbon intensity and greenhouse gas accounting are becoming an important component of LNG trade, giving rise to the concept of “carbon-neutral LNG,” which still makes up just a small fraction of the industry.

- Procurement of carbon credits does not negate the emissions from natural gas and LNG, and adoption of offsets should be paired with a broader and deeper reduction in the emissions intensity to ensure they remain conducive to meeting growing energy demand without needlessly jeopardizing global, national, and corporate efforts to reduce emissions.

Read the full study here.