Allegheny County’s Hotel Tax Fell Sharply in 2020

Summary of Study

2020 was a bad year for the hospitality industry, nationally and locally. Events were postponed or canceled and business and leisure travel was curtailed. As a result, bookings for hotel stays and revenue fell dramatically.

Operators of hotels, motels and, in recent years, Airbnb-type rentals, are required to collect a 7 percent hotel room rental tax for Allegheny County. The revenue is deposited in a special fund. Tax revenue climbed from $30.2 million in 2013 to $38.2 million in 2019. Aside from a slight decrease in 2017, annual collections grew each year during that period.

Read the full policy brief here.

Feature Charticle

Findings:

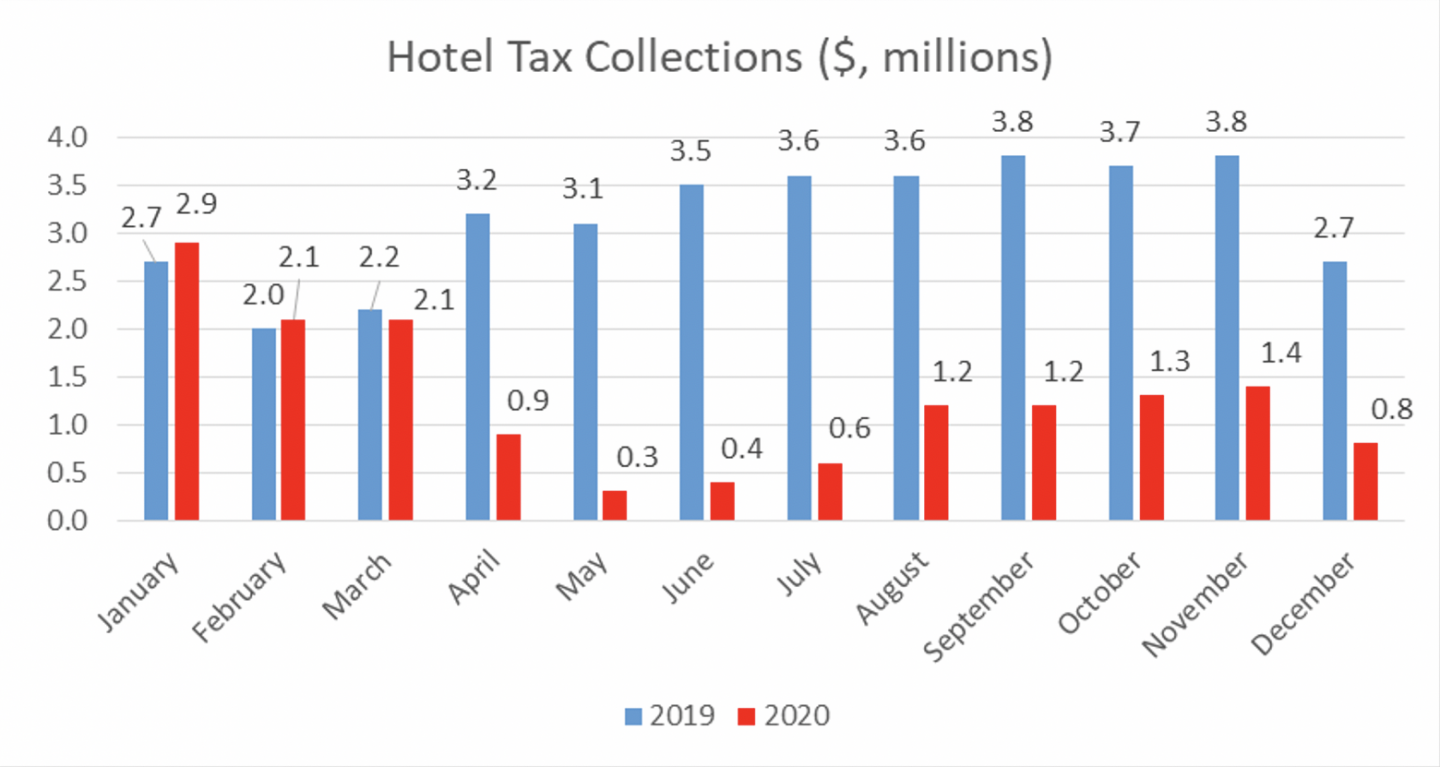

- In 2020, hotel tax revenue was $15.0 million, which was $22.7 million (60.2 percent) below 2019. There were two months where revenue exceeded the same month in 2019—January and February.

- May revenue was 91.8 percent lower than the previous May and represents the biggest year-over-year drop.

- June and July year-over-year losses were $6.1 million combined.

- With Pennsylvania removing pandemic mitigation orders at the end of May, will hotel business bounce back quickly? Or will it take several months or even years for travel-related activity to get back to pre-pandemic levels? The county’s fiscal plan for 2021 forecasted that by 2023, collections will total $29.1 million, well below the $38 million collected in 2019.

Read the full policy brief here.