Capitalism, Socialism and ESG

Bottom Line: Huge claims are being made for ESG (environmental, social and governance) investment strategies: ESG will reconcile society to capitalism while making investors – and Wall Street – more money. Yet, the thrust of ESG is to dethrone shareholders in favor of “stakeholders.” The current study analyzes the contradictions and problems of ESG investment. Contrary to claims, ESG leads to portfolio underperformance. ESG defies modern investment theory, for instance, because it shrinks the universe of stocks that can be invested in. Ultimately, the weaponization of finance threatens to end capitalism as we know it by lowering its ability to function as an economic system that generates higher living standards.

Signed onto by index funds, corporate leaders, and even some governments themselves, environmental, social and governance (ESG) is perhaps the biggest trend in finance and business today.

ESG proponents claim that investors following ESG precepts earn higher risk-adjusted returns because companies with high ESG scores are lower risk.

These claims are unfounded: ESG investing opposes modern investment theory because it shrinks what stocks can be invested in.

It is therefore not surprising that studies disprove claims of ESG outperformance.

For example, ESG factors were negatively associated with stock performance during the market Covid-19 recovery phase in the second quarter of 2020.

Meanwhile, the profit opportunities that ESG creates for Wall Street are quite clear.

BlackRock, the world’s largest fund manager, is pushing ESG as part of a marketing pitch to millennials, who put “improving society” ahead of “generating profits.”

BlackRock charges 46 cents annually for every $100 invested in its iShares Global Clean Energy ETF and just 4 cents for its iShares fund linked to the S&P 500.

Further, climate risk is primarily about the potential costs of future climate regulation, but the cookie-cutter climate disclosures required by ESG standard setters are systematically misleading because they treat the world as a homogenous regulatory space – something that it is obviously not.

Requiring corporations to bind themselves to unilateral greenhouse gas targets imposes a penalty in competing against companies less beholden to ESG ratings.

Regulation by governments is not only more efficient but also possesses democratic legitimacy.

Proponents argue that ESG is necessary to achieve inclusive capitalism, but political power wielded by a handful of billionaire Wall Street oligarchs actually provides a rather good definition of “insider capitalism.”

The weaponization of finance by billionaire climate activists, foundations, and even non-governmental organizations threatens to end capitalism as we know it by degrading its ability to function as an economic system that generates higher living standards.

This usurpation of the political prerogatives of democratic government invites a populist backlash.

Read the full study here.

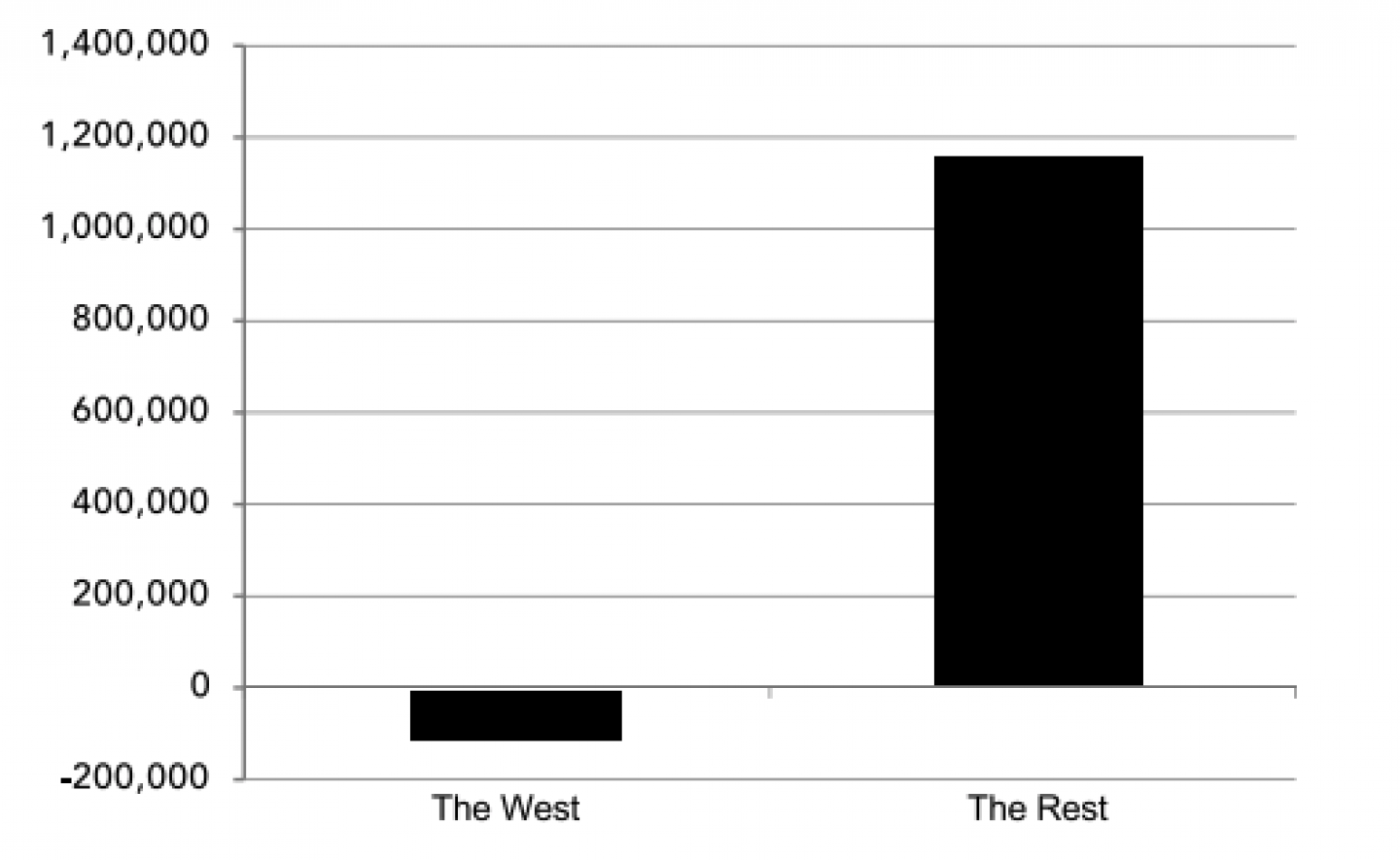

Change in Annual CO2 Emissions

From Fuel Combustion, Cement Manufacturing, 2002-2014 (kt)

Findings:

- ESG investing shrinks what stocks can be invested in, contradicting modern investment theory.

- Studies show that ESG stocks underperform, as demonstrated during the market recovery phase in the second quarter of 2020 through Covid-19.

- The profit opportunities that ESG creates for Wall Street, however, are indeed clear: Blackrock charges clients more for ESG investing.

- Requiring corporations to bind themselves to unilateral greenhouse gas targets imposes a penalty in competing against companies less beholden to ESG ratings. Regulation by governments is not only more efficient but also possesses democratic legitimacy.

- The weaponization of finance by billionaire climate activists, foundations, and NGOs threatens to end capitalism as we know it by degrading its ability to function as an economic system that generates higher living standards.

Read the full study here.