Valuing ESG: Doing Good or Sounding Good?

Bottom Line: Environmental, social, and corporate governance (ESG) considerations have become a critical aspect of investment decision making. The pitch that companies should focus on “doing good” is sweetened with the promise that it will also be good for their bottom line and for shareholders. The current study, however, concludes that the hype regarding ESG has vastly outrun the reality of both what it is and what it can deliver. The potential to make money on ESG for consultants, bankers and investment managers has made them cheerleaders for the ESG concept, with claims of the payoffs based on research that is ambiguous and inconclusive, if not outright inconsistent with some of the claims.

Using criteria based on environmental, social, and corporate governance (ESG) considerations has become an increasingly important aspect of investment decision making, particularly for high profile institutional investors.

Even on the corporate side, there has been a growing awareness of the need to be or at least appear to be socially responsible, either to fend off pressure from interest groups and media, or to market themselves to customers.

This paper examines the interaction between ESG related investment criteria and value, both from the perspective of investor wondering whether and how to incorporate social issues into investment choices as well as from the perspective of companies considering the value effects of being more socially responsible.

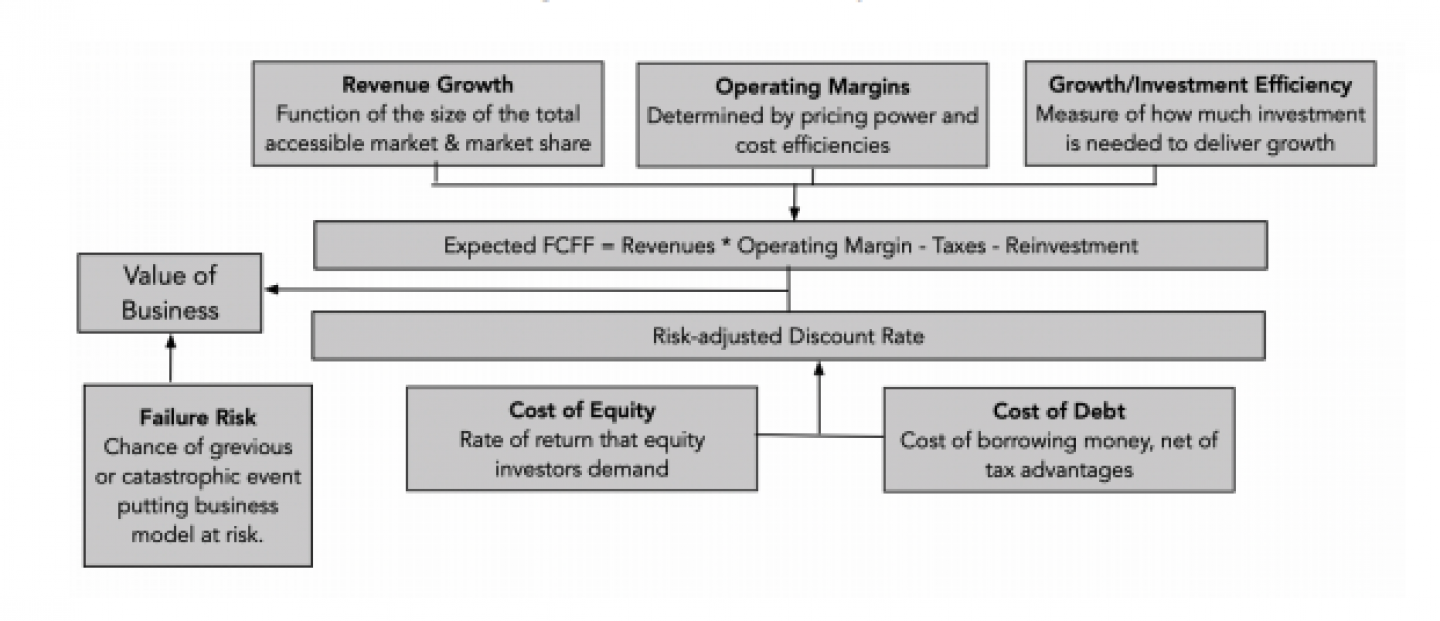

The researchers focus on how corporate social standing is measured, and then develop a simple valuation framework to examine how and where ESG choices made by firms play out in value.

Specifically, this study examines how being a “good” company can make it more valuable, and the drivers of that higher value, and also how being a good company can make it less valuable, casting doubt on the sales pitch of ESG’s most ardent promoters, which is that good corporate behavior will always be rewarded with higher value.

Much of the ESG literature conflates value changes and investor returns and the argument here is that positive returns to investors in companies that score highly on ESG are murky indicators of whether ESG is actually value-creating.

The debate around ESG and corporate social responsibility starts with the premise that we can differentiate clearly between “good” and “bad” companies, but that is clearly not the case.

Unlike profitability and returns, where there are accepted measures of both, and numbers to back them up, social responsibility is often in the eyes of the beholder.

The hype regarding ESG has vastly outrun the reality of both what it is and what it can deliver, but the cheerleading will continue because consultants, bankers, and money managers can make money off the pursuit of ESG.

Read the full study here.

The Drivers of Value

Findings:

- For ESG to increase company value, actions taken to improve ESG ratings have to result in either higher cash flows or lower risk, and there is the very real possibility that being good can lower value for some firms.

- The evidence that being good improves a company’s operating performance (increases cashflows) is weak but there is more solid backing for the proposition that being bad can make funding more expensive (higher costs of equity and debt).

- Investing in companies that are recognized by the market as good companies is likely to decrease, rather than increase, investor returns, but investing in companies that are good, before the market recognizes and prices in the goodness, has a much better chance of success.

Read the full study here.