Recent Developments for Allegheny County’s Retirement System

Summary of Study

This month marks seven years since pension reforms for Allegheny County’s Retirement System took effect. These reforms included lengthening the vesting and final average salary periods, along with capping overtime counted toward the pension benefit for employees hired on or after Feb. 21, 2014.

At the end of January 2021, there were 3,081 active employees who had been hired since the changes took effect. That means over 40 percent of employees are working toward a pension with the revised benefit structure.

Read the full policy report here.

Feature Charticle

Findings:

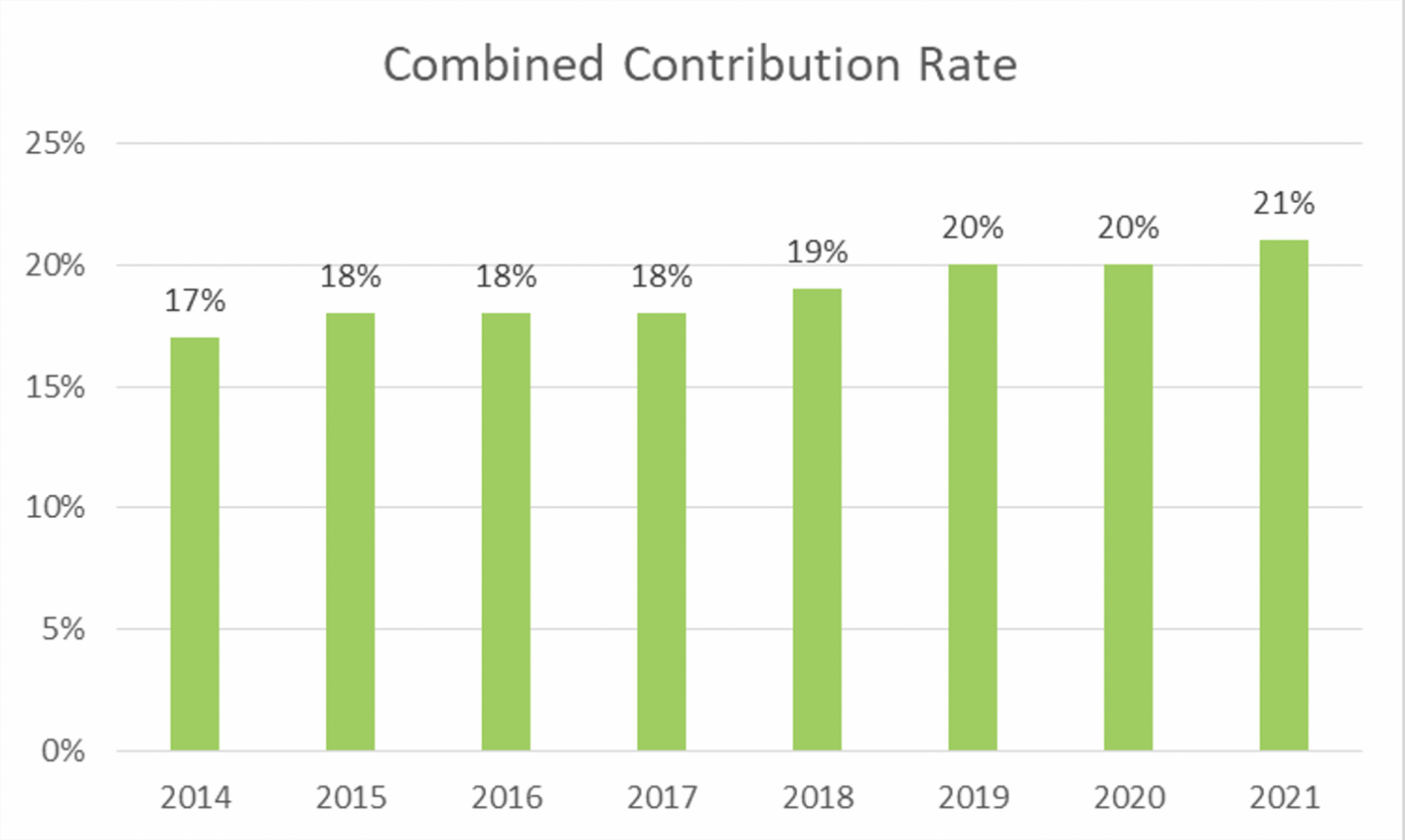

- Under the Second-Class County Code, employer and employee contribution percentages are required to match.

- At a 2011 system board meeting, a goal was adopted to raise the required contribution to 20 percent. The county raised the contribution rate in 2014, 2015, 2018, 2019, and 2021. The rate currently stands at 21 percent, meaning the employees and the county each contribute 10.5 percent.

- The county has to be aware of COVID-19 and its impact on economic activity and, in turn, county finances could have on the retirement system.

- In this uncertain environment, the county should explore all opportunities to streamline services, consolidate departments, and consider possible privatization or outsourcing to the private and nonprofit sectors where there are functions that can be carried out more economically on behalf of the taxpayers.

Read the full policy report here.