Household Rental Debt During Covid-19

Summary of Study

Bottom line: The Covid-19 recession has raised concerns about the rental housing market. It has become increasingly difficult for renters to make payments, hurting landlords, and disrupting housing markets. This study finds that policies to replace lost income for those affected by the pandemic have been highly effective at keeping renter households out of debt.

This report estimates the number of Americans with rental debt and the average amount owed. The study comes to four main conclusions:

- Many renters need support. Roughly one-quarter of rental household have dealt with some form of unemployment since Covid-19 began. The study estimates that about one-fifth of these households will owe $5,400 each in rental debt by the end of the year.

- Government relief programs — such as standard state UI, the supplementary $600 per week CARES Act UI benefit available from April through the end of July, and the Economic Impact Payments sent to households in April — have been very effective at preventing rental debt.

- Minorities and females have experienced a disproportionate amount of rental debt, consistent with earlier findings that the Covid-19 crisis has disproportionately impacted minorities.

- There are significant rental debt differences by state, reflecting differences in employment losses, rents, incomes, and unemployment insurance by state.

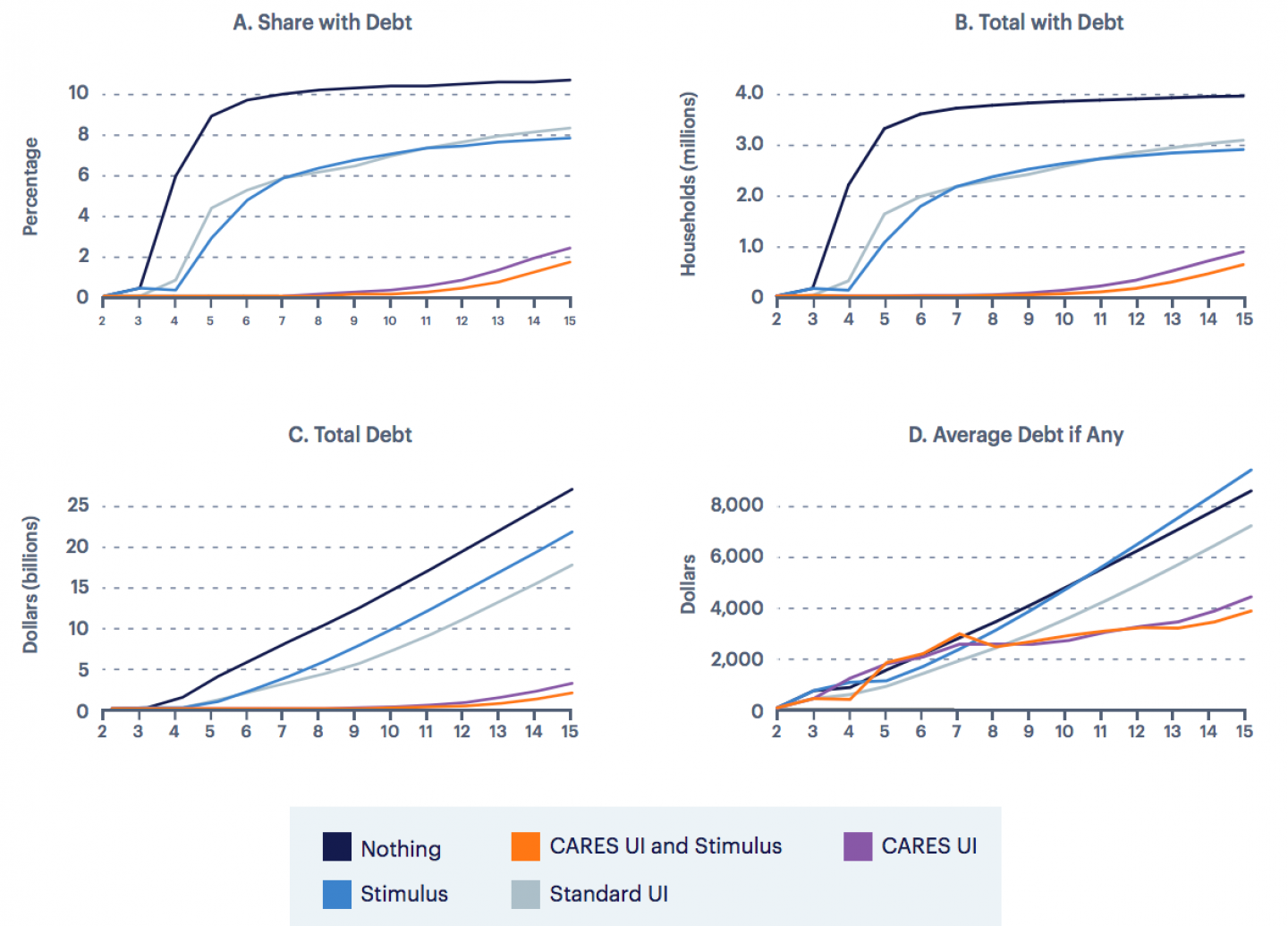

The study then models five different policy scenarios and their impact on rental debt:

- Nothing: This is the simplest scenario where no replacement income is given to workers who lose jobs.

- Standard UI: The standard state unemployment insurance provided to affected workers.

- Stimulus (without any UI): Economic Impact Payments are provided to boost renters' savings.

- CARES UI (without stimulus): Addition $600 in weekly supplemental federal unemployment benefits

- CARES UI and Stimulus: Households receive both the Stimulus and CARES UI scenarios.

The study concludes that renter households are helped to the degree to which they receive government relief. For instance, If every unemployed worker received UI with the CARES supplement and stimulus payments, only 125,000 households (0.4 percent of all renter households) would have any rental debt by December 2020. By contrast, if no unemployed households received UI or stimulus payments, 3.4 million (10.6 percent of all renter households and 45 percent of unemployed renter households), would have accumulated at least some rental debt by December 2020.

Read the full study HERE.

Feature Charticle

Findings:

- The number of houses with rental debt will vary substantially based on the relief policies enacted to help them.

- This study finds that various relief efforts substantially reduce rental debt, with more generous policies reducing debt more than less generous ones.

- For instance, If every unemployed worker received UI with the CARES supplement and stimulus payments, only 125,000 households (0.4 percent of all renter households) would have any rental debt by December 2020.

- By contrast, if no unemployed households received UI or stimulus payments, 3.4 million (10.6 percent of all renter households and 45 percent of unemployed renter households), would have accumulated at least some rental debt by December 2020.

- Women and minorities bear a disproportionate amount of rental debt.

Read the full study HERE.