The Texas Wind Power Story: Part 1: How Subsidies Drive Texas Wind Power Development

Bottom Line: Texas is a major wind producer, partially due to government subsidies. Yet the expansion of wind power has placed a strain on the state’s delivery system that resulted in large quantities of wind generation not making it to market. Texas ratepayers committed nearly $7 billion to resolve the issue. State policymakers need to be more proactive in protecting ratepayers in the years to come.

Texas experienced a sevenfold increase in wind production this century and now claims nearly 23,000 MW of wind representing 25% of the total installed in the U.S. Numerous factors influenced why Texas was able to achieve its rate of growth compared to other states. Due to federal subsidies, public-funded infrastructure expansion, and low barriers for wind power construction, the state remains attractive for further development.

Tax equity including the federal Production Tax Credit (PTC) and depreciation now accounts for over 50% of the capital needed to construct a typical wind facility. Around 50% of Chapter 313 agreements, which grant independent school districts the power to limit the appraised value of projects as a means of lowering the local property tax burden, involve wind energy facilities with a lifetime total cost of $1.56 billion as of 2016.

Subsidies, low natural gas prices, and competition from other renewable energy projects (including wind) have placed downward pressure on the price project owners can demand for their wind energy. These reduced prices are touted by the wind industry as a benefit to Texas ratepayers, but they are also used as a primary justification for Chapter 313 agreements.

Low natural gas prices and competition from other renewable energy projects have put downward pressure on the value of Texas wind power, which benefits electricity consumers. But these lower electricity prices are causing wind power producers to underbid their energy to a point where new project financials do not make sense without a Chapter 313 agreement.

In many cases, applicants are citing these low prices as a primary reason for needing a 313 property tax value limitation. At a time when Texans are being told wind energy is lowering energy prices, in fact, taxpayers are being asked to pay more.

There is evidence that viable wind projects can proceed without 313 value limitations. At least two wind projects that were denied 313 agreements were constructed in 2017 and a third began construction by 2019.

Read the full study here.

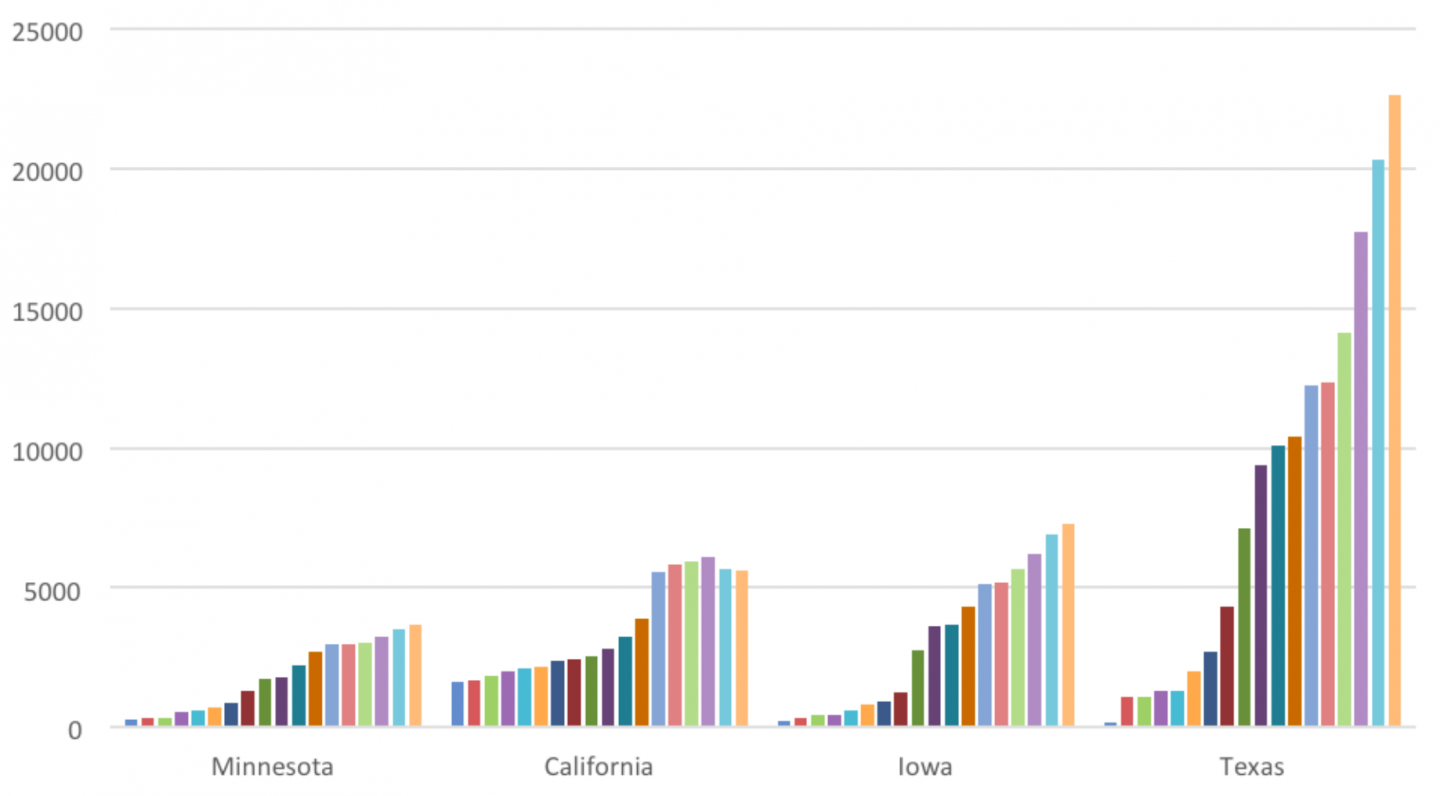

Wind States in Megawatts, 2000-2017

Findings:

- Texas experienced a sevenfold increase in wind production this century and now claims nearly 23,000 MW of wind representing 25% of the total installed in the U.S.

- Around 50% of Chapter 313 agreements, which grant independent school districts the power to limit the appraised value of projects as a means of lowering the local property tax burden, involve wind energy facilities with a lifetime total cost of $1.56 billion as of 2016.

- There is evidence that viable wind projects can proceed without 313 value limitations.

Read the full study here.