Fossil Fuel Divestment: A Costly and Ineffective Investment Strategy

Bottom Line: On the grounds of climate change, the movement to divest from securities associated with companies dealing in fossil fuels continues to grow. Varying degrees of divestment have been adopted by institutions and other investors, while rejected by others. Before divesting, however, the potential costs for portfolios and the likelihood of divesture contributing to desirable environmental goals must be considered. Fossil fuel divestment simply does not pass a cost-benefit analysis and can deliver a 25% reduction in portfolio growth.

In recent years, certain groups concerned with the potential effects of climate change have urged institutions and other investors to divest from securities associated with companies in the fossil fuel business. It is clear, however, that before divesting all investors must consider both the potential costs and the likelihood that divesture would contribute materially to environmental goals.

The economic evidence demonstrates that fossil fuel divestment is a bad idea. Investors seeking to comply with the goals of fossil fuel divestiture incur three key types of costs: trading, diversification, and compliance costs. Trading costs like commissions come in virtually every securities transaction. Costs associated with less portfolio diversification are a bedrock principle of financial economics. Ongoing compliance costs mean that every future securities transaction will need to be analyzed for potential environmental impact.

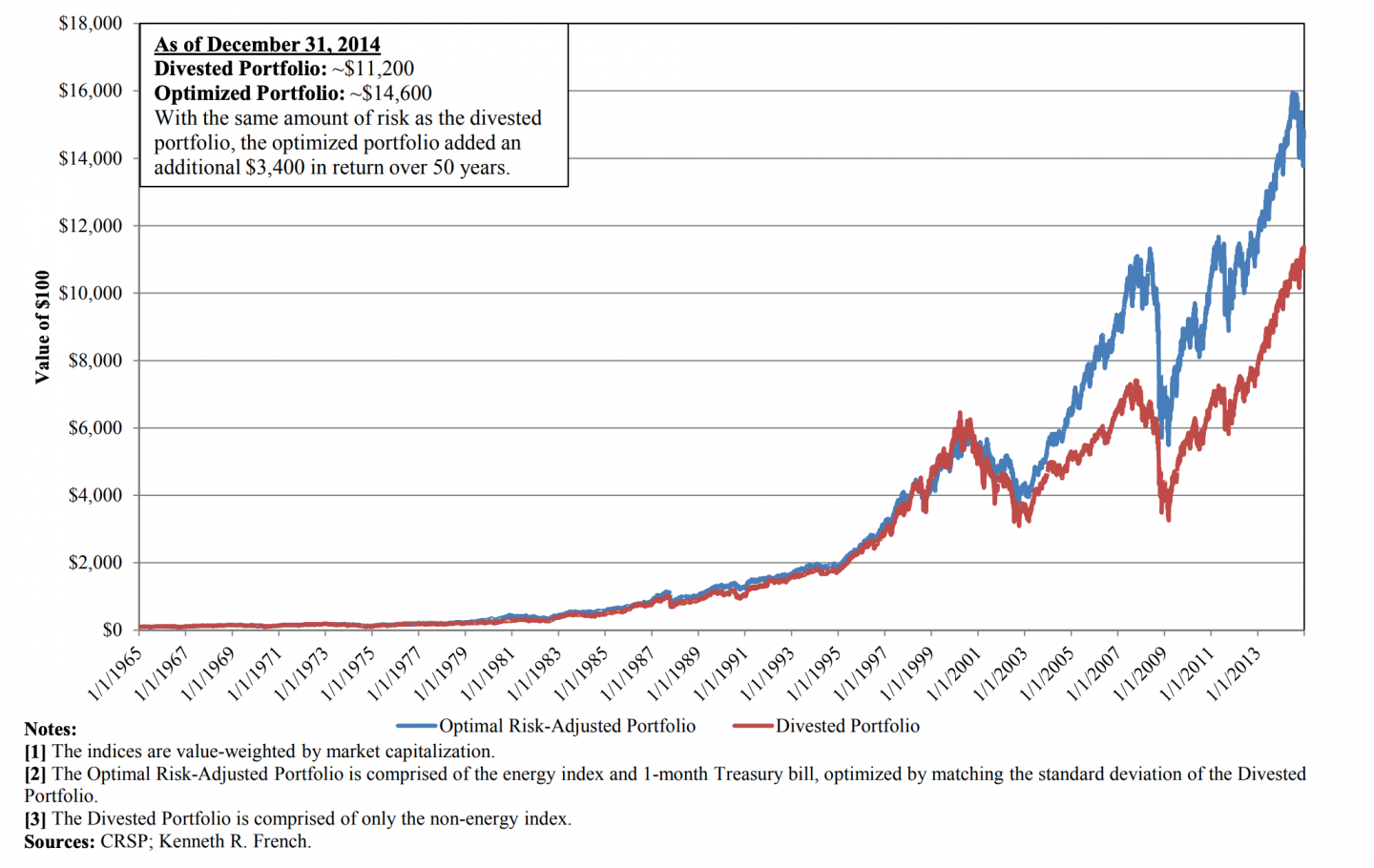

These costs have real financial impacts on the returns generated by an investment portfolio. Over the 1965-2014 period, for instance, the present analysis concludes that a divested portfolio delivered 25% less growth than an optimal risk-adjusted portfolio. In contrast, any environmental benefits from fossil fuel divestment are likely to be non-existent. Moreover, there is no basis to conclude that divestment can impact the stock prices or business decisions of targeted companies. This is why there is broad agreement among financial professionals and academics that divestment from fossil fuel companies cannot generate superior returns.

Finally, fossil fuel divestment is unlikely to impact public thinking on the need to address climate change, so advocates should seek alternative ways to promote environmental goals.

Read the full study here.

Optimal Risk-Adjusted Portfolio vs. Divested Portfolio 1965-2014

Findings:

- Investors seeking fossil fuel divestiture incur three key types of costs: trading, diversification, and compliance.

- From 1965-2014, a divested portfolio grew almost 25% less than an optimal risk-adjusted portfolio.

- Divestment campaigns are unlikely to impact stock valuations of companies.

- Divestiture is unlikely to benefit the environmental or impact public thinking on climate change.

Read the full study here.