Deconstructing the Pipeline Myth and the Case for More Diverse Fund Managers

Bottom Line: Racial minorities are underrepresented in startup executive roles -- especially when considering their high college attendance rates that should create a strong minority pipeline. Racial minorities also receive less funding when they are part of a startup. However, racially-diverse startups that proceed past the first rounds of funding raise more money and are more successful than their white counterparts. The racial disparity at startups must be addressed to improve equity and the economy.

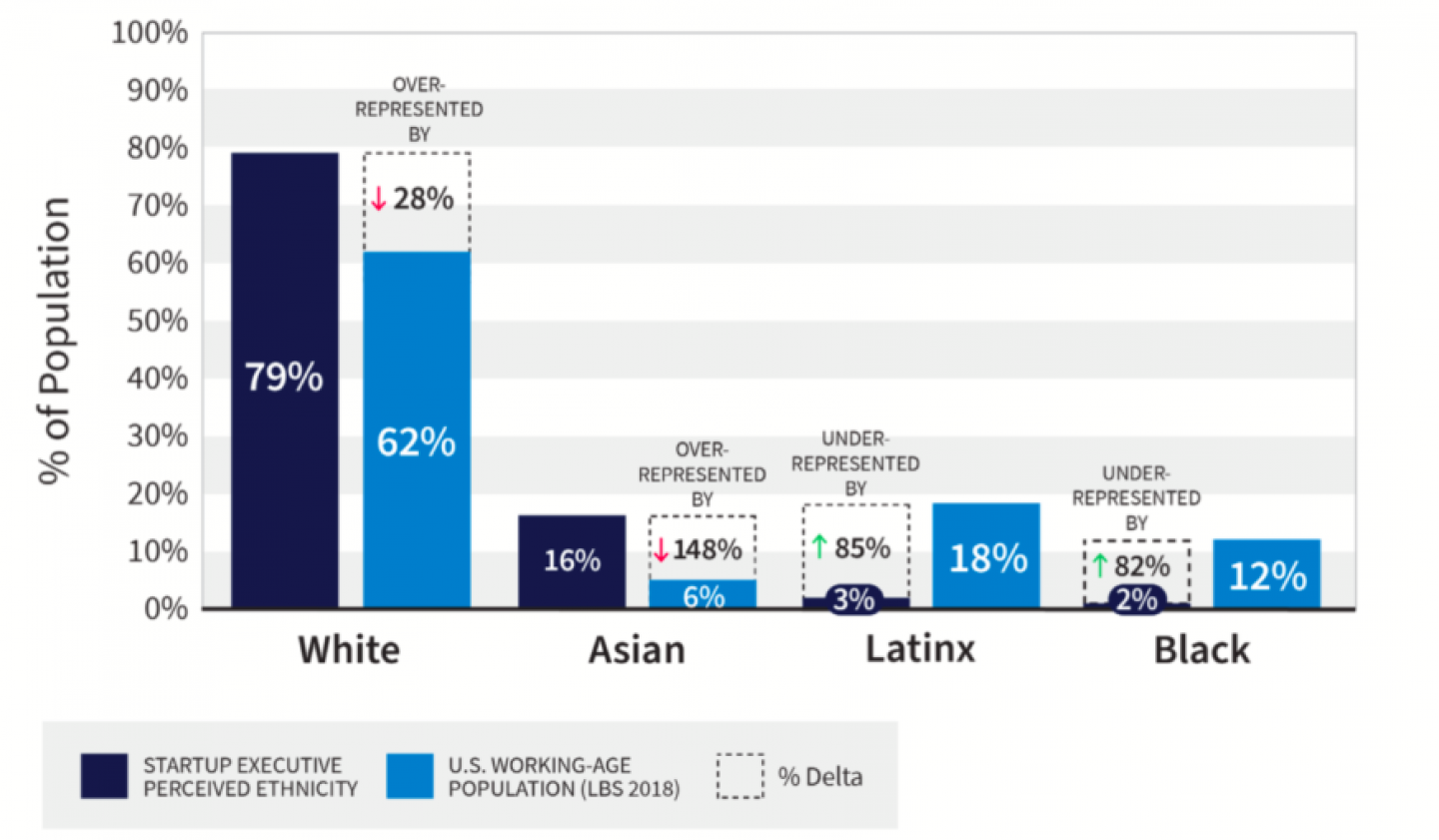

This study determines that 79.2% of startup executives are white, 15.6% Asian, 2.6% Latinx, 2.1% black, and 0.5% other. The data show a large discrepancy between the Latinx working-age population in the United States (17%) and Latinx startup executives (2.6%), as well as the Black working-age population (13%) compared to startup executive representation (2.1%).

While white and Asian groups are both over-represented in startup executive leadership, both Latinx and Black groups are more than 80% under-represented.

The pipeline can not be to blame for this underrepresentation of the Latinx and Black ethnicity in startups as the Latinx and black students have increased their post-secondary educational attainment by 350% and 55%, respectively, over the last four decades. U.S. startups need 6.7 times more Latinx and 5.6 times more black executives to match working-age U.S. demographics. These gaps are even more pronounced higher up the Fortune 500.

Diverse founding teams have much more limited access to capital than white founding teams, with 3 out of 4 venture capital rounds are going to non-diverse teams. However, diverse teams outperform homogeneous teams in late-stage funding. Diverse teams also generate higher returns to investors than white founding teams. This outperformance is caused by diverse team having broader viewpoints, stronger networks, and closer matches with their target customers.

As in other professions, venture capitalists invest in people that look like themselves, have similar views, and have similar upbringings. There is a strong disconnect between the people writing the checks and those who are working in the trenches to incubate and start companies. Ethnically diverse venture capital partners, who understand the nuances of different industries, products, cultures, and problems, are sorely needed.

Read the full study HERE.

Comparing Startup Executives by Race to the U.S. Working Age Population

Findings:

- Racial minorities are underrepresented in startup executive roles vs. their working-age population.

- This disparity is even more pronounced when considering that minorities are attending post-secondary education at higher rates, meaning there is no problem with the pipeline of minority talent.

- Though less common, diverse teams generate more late-stage funding and higher returns to investors than white founding teams.

Read the full study HERE.